A Gentle Introduction to Investing for Software Engineers (I) — Motivation

Planted July 27, 2018

Pruned June 9, 2025

You can access all the articles of the series through the following links:

(II) — Compounding interest and introducing other factors

(III) — Determining a company value and acquisition point

(IV) — My methodology to determine which stock to buy

If you are reading this article, chances are you a Software Engineer that has ended up here looking up for saving, investment or retirement advice. Or maybe you have a different profession, but ended up here anyway. It doesn’t matter, as long as this article can provide you some value. Recently, and in informal conversations with peers, investing came as a natural topic. I realized most of the peers in the industry do not have a clear strategy for retiring or investing their savings. I am summarizing here my knowledge and experience investing, and I hope it can be of your benefit.

You might realize that I have included the Roman numeric (I) on the title of this article. This means it will be part of a series I will be publishing, although I have not fully decided the content or extend. This is something I will do it on the fly — I think this promotes the benefit of taking interesting paths, depending on the feedback you can get from potential readers like you. So far, in this article I will focus on the motivation that pushed me to invest, and why I this think it is a great idea. We all have to deal with money. The better we know how to use it, the higher the quality of our lives.

Some situations described in this article are related to the Spanish/German legislation. Nowadays the schemas followed in this countries are widely similar among countries (taxes, retirement, unemployment, etc). European countries, and particularly north-European countries might have more generous community benefits than the average countries due to its social contract. It might not be the same in your country, keep this in mind.

I am not a professional investor, neither can give you professional legal or financial advice. I am describing my experience and what has worked out for me, how I learned it and how do I invest. Contrast this with other sources of knowledge, experiment, and create the system that works better for you.

Why for Software Engineers?

This is not an exclusive or elitist article, anybody can benefit from it. However, there are a few trends I believe we share in a particular profession. Since my profession is Software Engineering too, I believe I am in a similar situation to many of my folks.

- We can enjoy remote work very easily. This benefits our life in many senses: we can live in places that are cheaper or have a better taxing perspective while we focus on our daily tasks.

- We can also enroll in companies that are located in tech hubs — it is easier to find a job as a Software Engineer in Silicon Valley than on a tropical island in South East Asia. But you can actually live in SEA while working for a SV company.

- Software Engineer jobs are highly paid. As a consequence, many folks have cash remaining that the can use in other endeavours (investing, saving, starting their own company…)

- We fucking love creating our own tools.

Why would I need to invest?

Every one of us will have to deal with money in their lives. Know your options, so your life quality will increase.

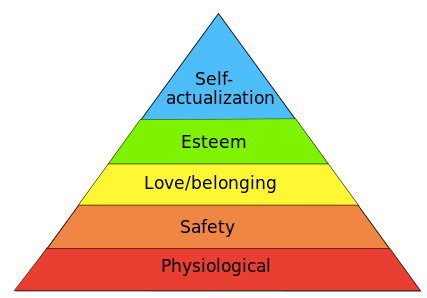

It is not about achieving Financial Independence (FI) in your 30s, or going into retirement being young. If you ask me about my personal motivations: I like what I do, I get recognisement, I help other folks and I have fun with it. I do not have a reason to stop doing what I do, but I want to have options in my life.

You can have a side passive income, that will allow taking better life decisions because cash is not a daily need anymore. Yes, you can also go into the early retirement. Or start a foundation or your own company. Or keep doing what you want. But now you will have this new wide spectrum of options you never had before. You will not live in a world of scarcity.

And you do not achieve it with savings, or a monthly paycheck.

A personal journey

I started investing around two years ago, and more heavily with a well-defined plan for around a year. Everything started when I jumped from the security of a permanent job into the realm of freelancing. After years of having a permanent job, I got addicted to the security of the paycheck and the corporate benefits. Without realizing, I provided an architecture to my life: 27 days of holidays per year, productivity bonus, retirement schema… everything sounded easy. The company or government were taking care of it, and I never had to take care of it.

Suddenly, those “privileges” vanished overnight. I am quoting “privileges” because those are not real privileges, but after many years we end up believing it. There were no more unemployment benefits. No retirement. Damn, my first gig was only three months long, and I think my cash savings by that time covered half a year of expenses! And even if the fee I was charging as a freelancer was significantly superior as my salary as a permanent employee, it would have taken ages to cash up a decent amount to get me close to the financial independence.

As a financially conservative person, I was naturally concerned about the destination of my hard earned cash. Investments like Bitcoin or other cryptocurrencies were too esoteric and distant for me. Real-estate investment was at that time a big and scary monster — signing a contract for 30+years where you have to do monthly contributions to your mortgage, and if dark times come the bank can take it from you? What a modern wording for “enslaving”. So I naturally ended up sliding into learning about investing in the Stock Market.

DISCLAIMER: I actually own a few BTC and LTC, but this was out of curiosity to learn how they worked and the process. Although I have obtained some capital gains, for me it was never a financial investment.

All the above-mentioned arguments have their own weight, but the heaviest one was that as a freelancer I was not entitled any more to a public retirement (if we are supposed to get fussy, I could be entitled in the future to a minimum wage retirement pension, but that was never what I had in mind. I wanted to retire on my own terms, or achieve the FI by myself). That means I would need to adopt a strategy to

A) Save enough money to create my own safety mattress and/or

B) Somehow create a passive income that could support me overtime.

The pyramid scheme of pensions

I am a Spaniard living in Germany for 11 years. Both in my country of birth and in the country of adoption, pensions are paid following the principle of “intergenerational solidarity”. The word “solidarity” might make you think that this means some sort of “good deeds for the benefit of all”, but it truly means a distribution of poverty. Some folks that identify themselves with the anarcho-capitalism and extreme capitalism consider this a conspiracy from the top spheres to keep the populace docile and servile. I tend to believe in the dictatorship of negligence more than in the dictatorship of evil: this happened as a result of several generations where this schema did not explode (as it happens during the first generations of a Ponzi scheme) and we got used to it as a frog gets used to the increasing temperature of water in a cooking pot. We are so addicted to the system and it is so entangled in our society that few people see how harmful and prejudicial it is.

The system works like this: current generations pay with their social contributions for the pensions of the generation that is currently retired. Numbers might vary from one country to other: Spain has 2,23 active workers per retiree. Germany 2,1. Developed countries (notably European countries + Japan) have the same problem: a stagnant birth rate, and an increasingly aging population. We rely on the hope of new contributors to the system to keep the boat floating, but mathematics are a bitch.

There are 35.7 million people contributing to the state pension system and 17.7 million receiving a pension in Germany. Supposing that the proportion of 2.1 workers per retiree does not decrease (already an act of faith) we will need 70 millions of people contributing to the state pension system to keep it alive when the current workers transfer to the pension system. And after that, we will need 140 million. And the list goes ad-eternum.

The pension system, as it has been designed, is a scam (or the composed result of many bad decisions taken over years) that is failed and the longer we wait to take action the worst it will be. You do not want to rely on it.

The stock

As many of us, I associated the stock market with a high-risk investment. We all have heard stories of how brokers earn and lose millions within a day. We all have seen “The Wolf of Wall Street”. Damn, it takes a lot of hard work to earn money, I do not want to lose it all!

It turns out these fears are unfounded. There are those daily traders, that conduct many operations a day in the stock market moving millions and billions a day. They are mainly called “computers”. There are other strategies in the market (FOREX, currencies, futures…) that might be more complex as well, or using tools such as leverage. You might end up eventually using them if you increase your financial knowledge, but for the neophyte I do not find them adequate. However, there is a strategy I didn’t know before, which suits most of the non-professional investors that want to find security over time on their hard earn cash.

It is called Buy&Hold.

Buy&Hold is nothing like you have seen in the films. It is a very boring investing strategy. You invest diligently (the amount that suits you every certain period) in big, sustainable companies that pay a significant dividend. Then you reinvest the dividends and let the compound interest work out for you.

But can I lose all my money?

Well, it is theoretically possible that you lose all your money. Maybe a meteorite crashes on the Earth, the world as we know it disappears and we struggle to survive. In that case, your investment can go wrong. Otherwise, chances are rare.

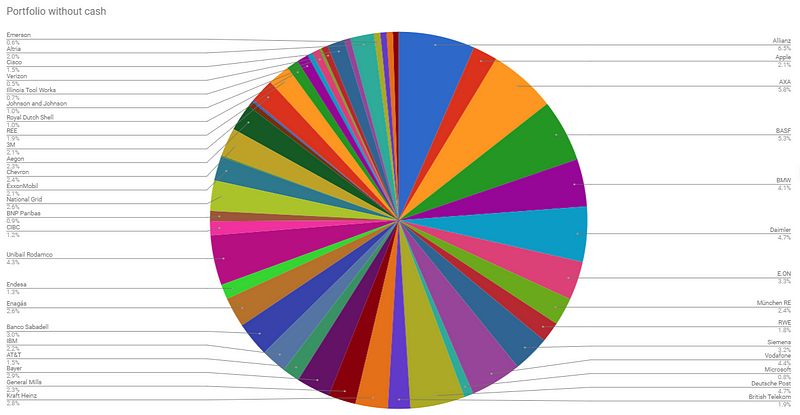

Think about this. You will be investing in big, boring companies that have been for a while on the market and they pay their boring dividend every year. They do not have an explosive growth, but they are stable. Think of companies like Allianz, Siemens, BMW, Bayer, Unilever, Apple, 3M, Johnson & Johnson, Coca-Cola… Would you imagine a world where all these companies disappear? Things should have gone terribly wrong by then.

On average, the stock market provides a 7% yearly return after discounting inflation and the dividends. The key here is the word average. The stock market has a high fluctuation, and this 7% might be -15% one year, +10% the next, +4% the next one… hence we are here for the long term, not for the short-term trading. We cannot predict the future, but we make decisions based on how the past was. And historically, with all its ups and downs, the stock investing has been a profitable and a secure investing.

The Buy&Hold strategy states that you acquire diligently stock from big, boring companies, hold it over time and reinvest the dividends. There are some key aspects here:

- Diversification per sector: it is key to include within your portfolio a sufficient diversification per sector. Imagine if you invest everything in the IT Market. You could have done tons of money in some periods of time, or lose a significant amount after the Web Bubble crashed. You do not want to make a lot of money in a short period of time, you want to boringly create your own portfolio and create your patrimony. Sector diversification is a must.

- Diversification per company: let’s say you want to have 15% of your portfolio in the insurance sector. It would be a bad idea to invest all your money in a company, let’s say, Allianz. Allianz is a great company apt for the long term, but nothing prevents any company from having a few bad years. If you decide to go for 15% of your portfolio in the insurance sector, you might want to include as well a couple of other companies (let’s say, Mapfre and AXA).

- Diversification per countries: during the Euro crisis, some countries (particularly in South Europe) were heavily affected. Some others (Central and Northern countries) were less affected. Some other world regions (Asia) had a strong growth. Over time you want to incorporate companies from different regions to provide stability to your portfolio.

- Temporary diversification: let’s say, you have now a significant amount of cash you want to invest. You decide to put everything on a set of companies you have chosen. Now you are lucky enough to do it on a period where the Stock Market is low, so they revalued quickly, providing you gains. Congratulations! Or maybe there is a crash afterwards, so you lose 50% of your investment value. That sucks. Invest wisely over time, so you can catch up all the different periods. You will go through depressions and optimism periods in a period of 10–20 years. So do it wisely and calmly.

It is key to keep in mind that the Buy&Hold strategy is a long-term strategy. You are aiming to obtain Financial Independence or create your own patrimony in a period of no less than 10 years, maybe 15 or 20. Each person has different situations: some might earn more than others, some might have a family, some might live more frugally than others… but obtaining a stable income from the dividends is something everybody of us can make. We do not need to be especially smart. And this will give us more security, will allow us to make better life decisions and be happier.

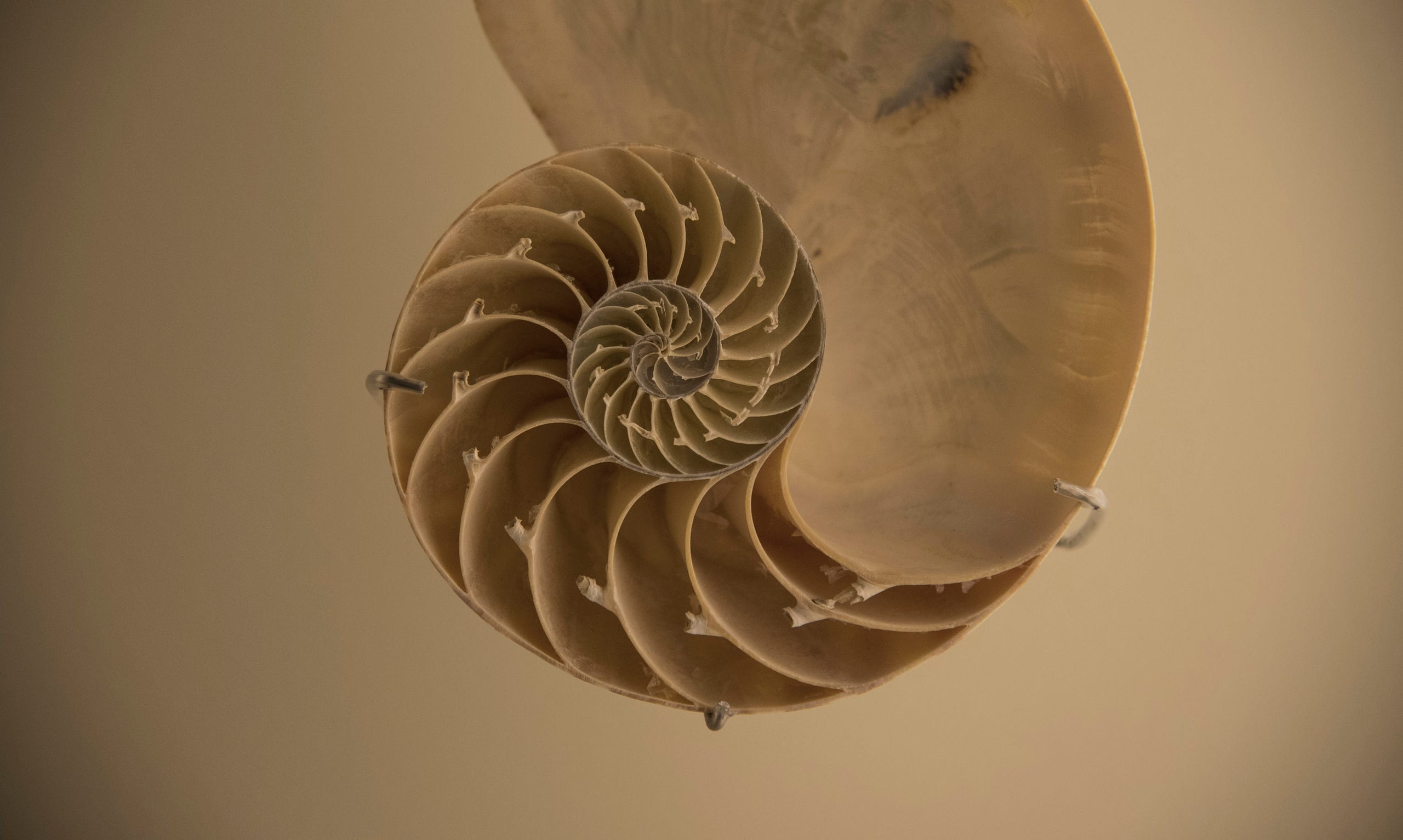

The compound interest

The key to the Buy&Hold strategy is the compound interest. Let’s put some simple numbers:

Our friend Frank can invest 100$ dollars every year in the Stock Market. After getting financial knowledge for some time, he decided it is time to invest. So the first year he invests 100$ in a few companies.

He gets during this year 4% in dividends, so we know has 104$ in his broker. The next year he invests again 100$, plus the dividends he already got. He has a total of 204$. Now the dividends are 8.16$. So every year, he actually invests more money from his savings, and reinvesting the dividends he gets dividends over the reinvested dividends.

╔═══════════╦════════════════════╦═══════════════╗ ║ Year ║ Total investment ║ Dividends(4%) ║ ╠═══════════╬════════════════════╬═══════════════╣ ║ 1 ║ 100$ ║ 4$ ║ ║ 2 ║ 204$ ║ 8,16$ ║ ║ 3 ║ 312.16$ ║ 12,45$ ║ ║ 4 ║ 424,61$ ║ 16,98$ ║ ║ 5 ║ 541,59$ ║ 21,66$ ║ ║ 6 ║ 663,25$ ║ 26,53$ ║ ║ 7 ║ 798,78$ ║ 31,95$ ║ ║ 8 ║ 930,73$ ´ ║ 37,22$ ║ ║ 9 ║ 1.067,95$ ║ 42,71$ ║ ║ 10 ║ 1.210,66$ ║ 48,42$ ║ ╚═══════════╩════════════════════╩═══════════════╝

Over a period of 10 years, Frank has invested 1.000$ of his own money. He has, however, a capital of 1.210,66$ that is already providing him 48,42$ a year. We have a linear growing (Frank can invest 100$ every year) combined with an exponential growing (the dividends paid over the re-invested dividends).

What we want with the Buy&Hold strategy is to create a portfolio of big, boring companies that pay us a dividend. Using a cattle metaphor, we want to have a lot of cows that give us a lot of milk. We do not care how fat the cows are.

This example is simplified for clarity, but we are lacking other key aspects:

- Dividends grow over time. Good companies increase their dividend over the years. There is a coined term, Dividend Aristocrats, referring to the company that increases their dividend over a certain amount of time.

- Stock valuation grows. Discounting the dividends and inflation, the stock has grown 7% over the years. So your invested money will actually be worth more over time

- Inflation: industrialized countries with no problems have an inflation rate of around 2%-3% over time. This makes the value of your money decreases, and it uses as well the compound interest. That is why leaving your cash on the bank is a bad idea! This also means, however, that Frank will earn more over time, and will be able to contribute more than 100$ per year.

In the upcoming article, I will explore more advanced examples taking into account these variables. I hope this introduction serves as an entry point into financing to the potential reader. Do not hesitate to write a comment if you have any question or something you would like to discuss.

Conclusions

- The public retirement scheme is a broken scam.

- Leaving your cash on the bank makes you lose on average 2%-3% of your hard-earned savings every year.

- The Stock Market, when an appropriate strategy follows, is a conservative approach, and more secure than most.

- Valuation and the creation of your wealth will come from the dividends.

I write my thoughts about Software Engineering and life in general in my Twitter account. If you have liked this article or it did help you, feel free to share it, ♥ it and/or leave a comment. This is the currency that fuels amateur writers.#### More where this came from

This story is published in Noteworthy, where thousands come every day to learn about the people & ideas shaping the products we love.

Follow our publication to see more product & design stories featured by the Journal team.