A Gentle Introduction to Investing for Software Engineers (IV) — My methodology to determine which…

Planted December 5, 2019

Pruned June 9, 2025

You can access all the articles of the series through the following links:

(II) — Compounding interest and introducing other factors

(III) — Determining a company value and acquisition point

(IV) — My methodology to determine which stock to buy

In this fourth and last article of the series, I will explain my methodology to acquire individual stock in the market. Most of the guidelines I expose are thought of as a guideline that you might need to adapt depending on your circumstances (for instance, the double taxation will play a role depending on your tax residence). I hope they can serve as an inspiration, and provide ideas to any fellow investors.

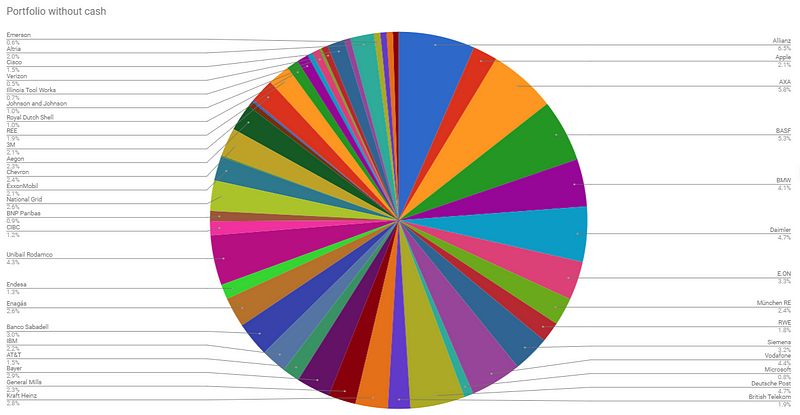

Determining our portfolio

The most important thing to do is to determine how do we want our portfolio to look like. For investors looking for a dividend based portfolio and DGI companies, the main components should be defensive companies, and incorporating over time more DGI companies. This is how my current portfolio looks like:

This portfolio does not reflect my ideal state (although it is on its way). I would ideally like a composition with approximately 60% of my companies in the defensive sector. Since this is a long term project, you do not need to worry about not fulfilling the percentages from the beginning. Keep in mind the figure you feel more comfortable with, and move towards that direction.

Since I am a German tax resident, I initially added a few German insurance companies that were cheap at the time (Allianz and München RE), and a few automotive companies (BMW and Daimler). This was before I started internationalizing my portfolio, and until now has decompensated the percentages I want. However, in the long term (a few years from now) I will be moving towards my desired direction.

Another important point is to keep several companies per sector. Let’s think of Communication Services. There are a few companies that could be acquired (AT&T, Vodafone, Verizon, Telefonica…). We can determine which company is performing better right now, but not which company will do it better in a few years. That is why you should always own at least two or three per sector and country.

Company distribution

As a rule of thumb, I avoid having more than 5% of weight for an individual company. If all companies of my portfolio have a 5% representation, I would have a maximum of 20 companies, but note that we are talking about a maximum here.

This is a representation of my current portfolio in December’19:

As you can see, a few companies exceed this 5% (Allianz and Axa). This is perfectly normal since some companies might grow from the original price of the acquisition, and the percentage will exceed. When a portfolio is being created, any new acquisition will decompensate it by a factor — for instance, think of a portfolio of 10K USD, and a new acquisition of 1K USD. Think of this as a long term goal — as a rule, no company should exceed a percentage that you estimate.

The motivation for this is to diversify and protect ourselves from the Concorde Fallacy. The main problematic impediment for investors is our own psychology, and when a stock looks cheap, we might be tempted to keep over-investing in it. If the stock keeps sinking, this can result in looses or a missed opportunity. Over my investing lifetime, I have realised that there are always many stocks that are cheap at a single time. Diversify by specifying a maximum percentage you want for each stock — and at the same time, do not obsess too much about it.

Similarly, I have declared percentages for each company type. Utilities (Enagás, REE, E.ON, RWE…) and consumer defensive (Johnson and Johnson, General Mills…) can be on the upper side of the spectrum (3–5%), whereas I prefer cyclical companies (automotive, energy…) to be on the low side (1–3%). Again, those are approximated percentages that should not be followed “too” strictly.

Having this diversification protects us. Let’s remember Kraft Heinz: they cut their dividend in February by 36%. If you would have (for instance) 50% of KHC on your portfolio, your income would have been reduced by 18%. If you are holding only 3% of KHC of your portfolio, your income would be reduced by 0.6% — this is negligible, and probably covered with the increase in other companies.

Price to Earnings Ratio (PER)

As I mentioned in my previous article, the Price to Earnings Ratio (or PER) is the measure of the share price relative to the annual net income earned by the firm per share. In a nutshell: it shows us “how much we pay in order to earn money”. There is no unique number that specifies what a good (cheap) PER is and what is not. In some literacy, 15 is taken as the standard value for PER (neither cheap or expensive), but this is a wrong measurement. PER should be considered as follows:

- Historical PER of the company: how was the PER of a company, and how it compares with the current one?

- PER in the same sector: how are other companies in the same sector (insurance, technology, utilities…) comparing with the desired company?

For instance: BMW has a PER of approximately 9 (that means, every 9 years it earns as much as it is valued), whereas General Mills has 17. Does this mean that BMW is cheaper than General Mills?

The right thing would be to compare BMW and General Mills with companies of their own sector. For instance, we could take Daimler, and see that the current PER is 13. And we could take Diageo, and check that the PER is 23. We can even search for the history of the company for a given ratio. Let’s check in the following graph the historical PER of General Mills — right now is rather on a high historical value:

https://www.macrotrends.net/stocks/charts/GIS/general-mills/pe-ratio

https://www.macrotrends.net/stocks/charts/GIS/general-mills/pe-ratio

As a summary: I prefer to buy companies that are on a historically low PER compared with themselves and their sector.

Dividends

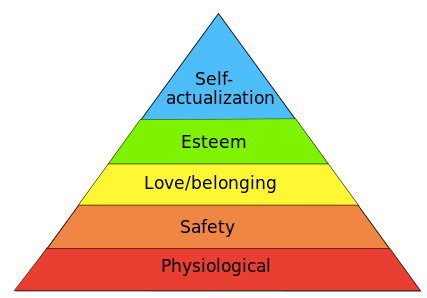

When I started my investing career, I would only invest in companies with a high dividend yield (5%+). At that time, those companies were Vodafone, Daimler, BMW, Unibail… With the time I have seen that a high dividend can be a premonition for problems — in many cases, this is symptomatic of company problems, and will likely be cut in the future.

There is no problem to invest in companies with high dividend yield even if it is reduced, especially at the beginning. This helped my portfolio to grow faster, since I was getting at the beginning big dividend yields, and I was reinvesting them and getting increasingly higher yields. However, now that my portfolio is more shaped, I am trying to incorporate DGI companies — companies that will grow sustainably their dividend over time.

Let’s see the following graph: company A paying an initial dividend of 3% and growing 10%, versus company B paying an initial dividend of 7% and growing 3%.

After 23 years, company A has surpassed the high yield company and keeps growing much faster than company B.

You need to evaluate based on your own circumstances the percentage you want for each type of company. In my case: since my portfolio has already a decent size, and I do not need to accelerate the snowball, I am starting to swing towards companies of type A. I keep my high dividend yield companies, and they provide a nice fuel to feed DGI companies.

The ability for a company to pay growing dividends in the future is sustained by a few factors: growing EPS (earnings-per-share), contained payout (amount of cash being paid from dividends), reduced or controlled debt and other circumstances (defensive companies are more likely to be DGI than cyclical ones, for instance).

Repurchases

Some companies have a plan to repurchase stock, and although this does not immediately mean an increase in our dividends, over time it helps. Dividends that are repurchased are out of circulation. For instance, if a company owns 100 stocks and repurchases 10%, there are now 90 in circulation. If this company was having an EPS of 1, now the EPS will be 1.1, without having done anything in particular — and this extra benefit can be distributed among shareholders. Check out in this graph some information combining companies' yield with their repurchase program.

For instance: Cisco has been paying only 2.74% on dividends, but it has repurchased 9.98% of its stock. That is an impressive combined number of 12.72%. Furthermore:

Cisco dividends in 1Q2020 = 1.486 Mill

Cisco dividends 1Q2019 = 1.500 Mill

They are paying less cash in dividends, but the dividend yield has increased by over 6% from 1Q2019 to 1Q2020.

As a summary: I consider companies both by their buyback and dividend yield.

Ranking

Another thing I have started lately to take into account is to add more companies belonging to a denominated rank (aristocrats, kings, champions). Aristocrats companies have been paying growing dividends for 25 years and belong to the S&P500. Kings have been paying growing dividends for at least 50 years and belong to the S&P500. Champions have been paying growing dividends for at least 25 years, and do not necessarily belong to the S&P500 (requirements for European companies are different). This is my current ranking distribution:

Over time, I will feel more comfortable with at least 50% of my portfolio belonging to a rank. Past benefits do not ensure future benefits, but companies that have a growing dividend policy have been highly profitable historically, and they have lower volatility than the index.

Geographical considerations

Depending on our tax residence, we are subject to double taxation. For instance, if you live outside France you are subjected to French double taxation (15% right now, and at the top of that your own local taxes). This can become a burden.

I am a German tax resident, so German companies are the best ones I can acquire. Dutch and UK companies have 0% foreign taxation, so I incorporate them into my mix. France and Canada have higher taxes than other countries, whereas Spain and the US have acceptable ones. I take those things into consideration when I am acquiring stock. This is my current geographical distribution:

If I am following a company that belongs to Germany, the UK or Netherlands and I am convinced by their fundamentals, I will add this company to my portfolio. Almost the same for Spain and the US (lower taxation). However, if the company is in France or Canada, I consider it twice before acquiring.

I currently hold two french companies: AXA and Unibail Rodamco, and Canada Imperial Bank of Commerce.

- I hold AXA for being one of the best insurance companies in Europe and the world, and having acquired it during a cheap period.

- I hold Unibail Rodamco for being the only European REIT, with premium units in most of the European major cities.

- I hold CIBC for its very healthy fundamentals, and for having paid a dividend for more than 120 years.

One French company I have been following for a while now, Engie, has nice fundamentals and I believe it is on a very good moment to acquire (has finished some investments to increase productivity, is expanding in some other countries and has finished repurchasing some stock). However, I have already several utilities from different countries, and at this moment there are better companies I can acquire.

The geographical distribution provides another mean in terms of diversification. Currently, the US economy is growing stronger than the European economy, but this has not always been like this, and it might change in the future. Investing in companies from different geographical regions, in different currencies and with different countries exposition adds diversification to our particular cocktail.

Timing

I do periodic contributions to my portfolio. I reinvest the dividends as they come (normally putting them together to make bigger acquisitions), and I do monthly transfers to my broker at the beginning of the month, following the principle Pay yourself first. Every extra cash flow I receive from different sources is automatically sent to the broker. In fact, I do not keep too much in cash — something between 6–10 months of living expenses. This approach was scary at first, but it has helped to grow the snowball more than I was expecting when I started. Over time, the passive income has grown to a point where it covers most of my expenses.

Some folks prefer to wait until the prices are lower and do their purchases. I do follow prices as a hobby and invest also frequently when there are random market drops, but I do not obsess too much about it.

Community

I cannot analyze all the companies in the market — that would be unfeasible. So I rely on other sources. I have added my portfolio to Seeking Alpha, and there are a few investors I follow there, and I read their analysis. Their analyses do not necessarily convert into a buy from my side, but I read them with attention.

There are some individual folks I follow and chat with. There is a huge Spanish community I have the pleasure to belong. I check the analysis of Snowball, Capturando Dividendos and Gregorio. There are some channels where we communicate (forums, Telegram groups and Twitter), and we exchange ideas.

A practical example

In my very particular circumstances: for my upcoming acquisitions, I am considering companies such as Texas Instruments, Cisco (increasing dividends over the last year, nice buyback programs, low representation on my portfolio, historically cheap), Enagás, REE (high yield, low representation on my portfolio, defensive sector), SPG (historical lows, nice dividend yields), Diageo (nice buyback program, historical lows, nice dividend increase, no representation yet on my portfolio, geographical diversification), etc.

Other considerations

Since this is a long term game, I do not care too much about the initial acquisition price. The companies I acquire will rarely be sold, so the price does not matter too much. In fact, I do not compare my portfolio performance with the S&P500 or by its growth. The main metric I use is how many dividends I am getting this year in comparison with the last year, and how many dividends I will be receiving this year in comparison with the last year. This year I have earned 38.2% more than in 2018, and I forecast for 2020 an increase of about 26–30%. I also have a calculator where I can input the dividend growth per year, my yearly contribution and taxes, and see how this will grow over time. I have released a light version of my template that you can use here.

I do choose also companies with a Wide Moat, high capitalization and generally belonging to an index — the so-called blue chips. They are the companies that most likely will be with us in 30 years.

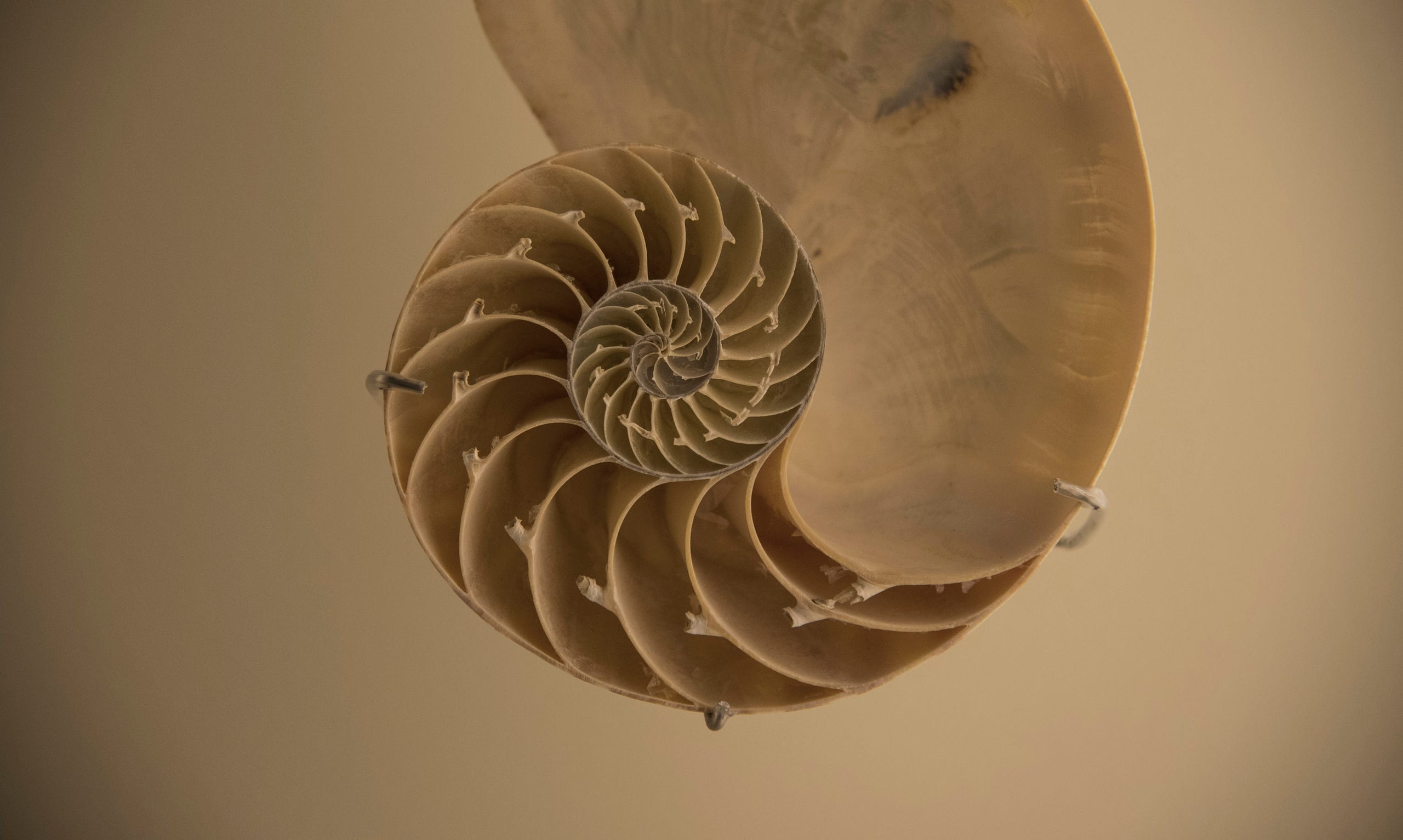

Some last words: if you are investing long term, you are choosing a selection of excellent companies from around the globe, and distributing them in your portfolio. You reinvest all the income, and keep contributing towards it. This has a compounding effect, and over time the snowball grows and it keeps growing alone. You are investing in real-world companies (that means, the products you buy and use every day) and holding them for a lifetime period. It is almost impossible to go wrong with this approach, it just takes time to see the effects.

I write my thoughts about Software Engineering and life in general on my Twitter account. If you have liked this article or it did help you, feel free to share it, ♥ it and/or leave a comment. This is the currency that fuels amateur writers.